SCANOLOGY has just introduced NimbleTrack Gen2. With upgraded technology, SCANOLOGY's NimbleTrack Gen2 is capable of scanning large and complex areas significantly faster, while maintaining measurement-level accuracy. This is the next generation of the company's mobile optical tracking and 3D scanning systems. SCANOLOGY's NimbleTrack Gen2 is designed to deliver higher performance, especially in speed and measurement range.

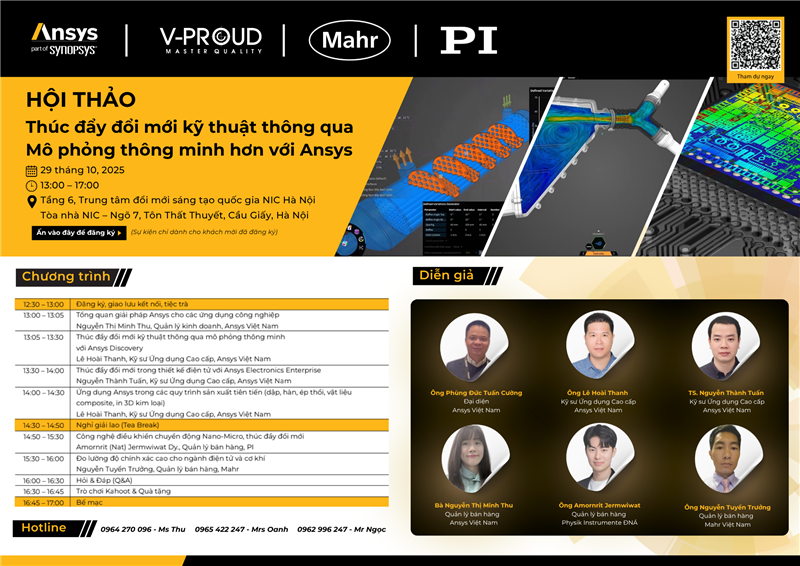

A breakthrough opportunity for R&D processes awaits the Vietnamese engineering community. The specialized workshop "Driving Engineering Innovation Through Smart Simulation" organized by ANSYS will take place on October 29, 2025, at the Innovation Hub Building, updating the latest advanced simulation solutions for the manufacturing, electronics design, and Nano-Micro industries.

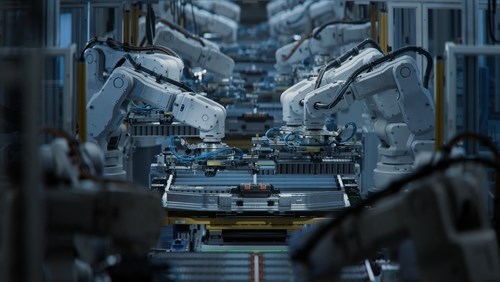

In the global race to automate manufacturing, China is emerging as a pioneer with the “dark factory” model – where robots and artificial intelligence completely replace humans. Requiring no light or rest, the new generation of factories operate continuously 24/7 with superior precision and efficiency.

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products.

January 2022 U.S. cutting tool consumption totaled $159.9 million, according to the U.S. Cutting Tool Institute (USCTI) and The Association For Manufacturing Technology AMT). This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 2.7% from December’s $164.3 million and up 10.5% when compared with the $144.8 million reported for January 2021.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“As the cutting tool industry continues to adapt to the changing economic climate on the globe, we see the sales volume moving back toward the pre-pandemic levels. Volumes that were expected to be higher were lowered by continued economic uncertainty, driven by inflation. The cutting tool industry’s willingness to adapt to changing market conditions will determine our future direction,” commented Brad Lawton, chairman of AMT’s Cutting Tool Product Group.

Steve Stokey, executive vice president and owner of Allied Machine and Engineering, said, “The cutting tool data indicates we are continuing to trend in a positive direction, although the overall growth appears to be flattening. If manufacturing was not already dealing with enough challenges coming out of the pandemic, it will now see how the war in Ukraine and the energy policies of this administration impact the numbers moving forward.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Read Quality Mastery magazine to get more information about quality management: https://qualitymastery.v-proud.vn/

If you are looking for quality management solutions, visit the following websites: v-proud.vn/product and doluongcongnghiep.vn.

Source: amtonline

(84) 896 555 247