SCANOLOGY has just introduced NimbleTrack Gen2. With upgraded technology, SCANOLOGY's NimbleTrack Gen2 is capable of scanning large and complex areas significantly faster, while maintaining measurement-level accuracy. This is the next generation of the company's mobile optical tracking and 3D scanning systems. SCANOLOGY's NimbleTrack Gen2 is designed to deliver higher performance, especially in speed and measurement range.

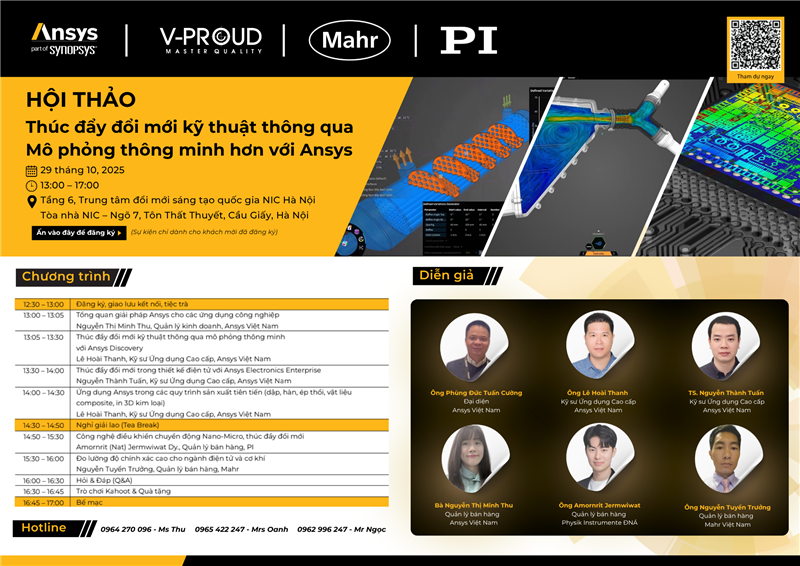

A breakthrough opportunity for R&D processes awaits the Vietnamese engineering community. The specialized workshop "Driving Engineering Innovation Through Smart Simulation" organized by ANSYS will take place on October 29, 2025, at the Innovation Hub Building, updating the latest advanced simulation solutions for the manufacturing, electronics design, and Nano-Micro industries.

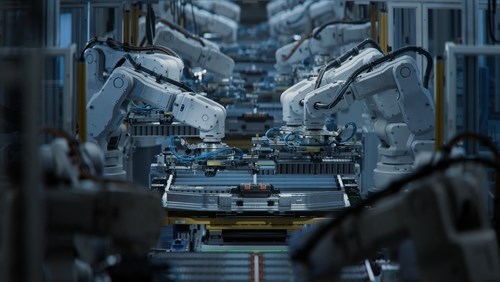

In the global race to automate manufacturing, China is emerging as a pioneer with the “dark factory” model – where robots and artificial intelligence completely replace humans. Requiring no light or rest, the new generation of factories operate continuously 24/7 with superior precision and efficiency.

It was reported that business at ZEISS’ four segments developed very well over the past fiscal year.

The ZEISS Group has reported that it ended its 2020/21 fiscal year (reporting period ending 30 September 2021) with revenues rising by 20% to 7.529 billion euros (previous year: 6.297 billion euros) with over 90% of the reported revenue was generated in markets outside Germany. Earnings before interest and tax (EBIT) also achieved a new high for the ZEISS Group, reaching 1.479 billion euros (prior year: 922 million euros). The EBIT margin was 20%. Incoming orders increased to 8.974 billion euros (prior year: 6.814 billion euros).

“2021 is a very special year for ZEISS. 175 years ago, Carl Zeiss laid the foundations for a company that has grown into a technology leader and proves time and again that it can push the limits of what is technically feasible. We are of course particularly delighted to have achieved record results once again in our anniversary year,” said Dr. Karl Lamprecht, ZEISS President and CEO. “While there is certainly room to improve in a number of areas, double-digit growth across all four ZEISS segments demonstrates that we are on the right path thanks to our balanced portfolio and our ZEISS Agenda. Upwards of 35,000 employees, a high capacity for innovation, as well as excellently aligned segments and all regions contribute to this growth.”

It was reported that business at ZEISS’ four segments developed very well over the past fiscal year.

The Industrial Quality & Research segment benefitted from market stabilization. The microscopy solutions business continued to develop well and achieved two-digit growth. Higher demand was recorded in the life sciences and electronics. The business for industrial quality assurance solutions has recovered. Sizeable investments in alternative drive technologies for the automobile industry offer new growth potential for ZEISS: microscopy and quality assurance solutions are increasingly deployed in battery research and in quality assurance for battery production.

The Semiconductor Manufacturing Technology segment achieved another record result in the past fiscal year. There has been sustained high demand for the innovative extreme ultraviolet (EUV) lithography systems and deep ultraviolet (DUV) lithography systems. Chips produced using EUV technology are deployed in the latest smartphones. The next EUV generation, High-NA EUV, will enable the production of even higher-performance and more energy-efficient chips at a lower cost.

The Medical Technology segment reported a considerable increase in its turnover despite a fraught situation in its supply chain. The segment benefitted from strong growth in recurring revenues like consumables, implants and services in ophthalmology. Microsurgery sales also continued to recover. At the end of the fiscal year innovations were unveiled for cataract and refractive laser surgery and for digitalization.

The Consumer Markets segment has recovered from the impact of the COVID-19 pandemic and generated clear growth. In ophthalmology, innovations related to ZEISS branded lenses in particular, as well as digital products and services and rising purchasing power in emerging countries, all contributed to this growth. The conditions for logistics and delivery reliability will remain challenging. Innovations for nature observation and hunting, and the expansion of strategic partnerships for mobile photography, have allowed the company to compensate for declining demand for camera and interchangeable lenses.

Distinct revenue growth was achieved in the Americas and APAC regions in particular. Growth was also reported in the EMEA region. ZEISS’ global structure therefore contributed to stability once again.

Summary of revenues generated in 2020/21 by the four ZEISS business segments are as follows:

|

|

Revenue (in billions of euros) |

||

|

|

2020/21 |

2019/20 |

Change (adjusted for currency effects) |

|

Semiconductor Manufacturing Technology |

2.298 |

1.833 |

+25% (+26%) |

|

Industrial Quality & Research |

1.801 |

1.640 |

+10% (+12%) |

|

Medical Technology |

1.951 |

1.647 |

+18% (+22%) |

|

Consumer Markets |

1.394 |

1.099 |

+27% (+30%) |

Expenditure on research and development was further increased and amounted to 943 million euros, or roughly 13 percent of revenue (prior year: 812 million euros). This was done primarily through the ZEISS Semiconductor Manufacturing Technology segment’s development roadmap as well as in the areas of digitalization and product innovation.

“To continue impressing customers with our innovations, we are making sizeable investments in research and development and have taken major steps in the name of sustainability,” said Dr. Christian Müller, Chief Financial Officer of Carl Zeiss AG. “Sustainability is an integral part of our strategic ZEISS Agenda 2025. Five different working groups are focusing on topics like green infrastructure, green business models and social engagement in a bid to achieve outcomes that are both far-reaching and sustainable,” said Müller. “That’s because ZEISS aims to operate in a carbon-neutral way in its own activities worldwide by 2025.”

ZEISS’ targeted innovation strategy, combined with substantial expenditure on research and development and other investments, is a cornerstone of the company’s accelerated growth. This also includes the targeted expansion of infrastructure, for example at the headquarters in Oberkochen, the ZEISS high-tech site construction project in Jena, and the newly opened ZEISS Innovation Center in Dublin (California, USA).

ZEISS’ new collaborations and acquisitions in the past fiscal year include its partnership with global technology player vivo in the area of mobile imaging, which was announced in December. This partnership focuses on a jointly developed camera system.

Moreover, ZEISS acquired a majority stake in arivis AG in order to expand its offering in the microscopy business with innovative 3D and big data software solutions. This is how the company is bolstering its software skills and market position in the field of 3D visualization and analysis technology.

ZEISS recently announced its acquisition of Capture 3D, a top US-based company that distributes solutions for optical 3D metrology. With the completion of this transaction, Capture 3D became part of the ZEISS Industrial Quality & Research segment.

Read Quality Mastery magazine to get more information about quality management: https://qualitymastery.v-proud.vn/

If you are looking for quality management solutions, visit the following websites: v-proud.vn/product and doluongcongnghiep.vn.

(84) 896 555 247